Description

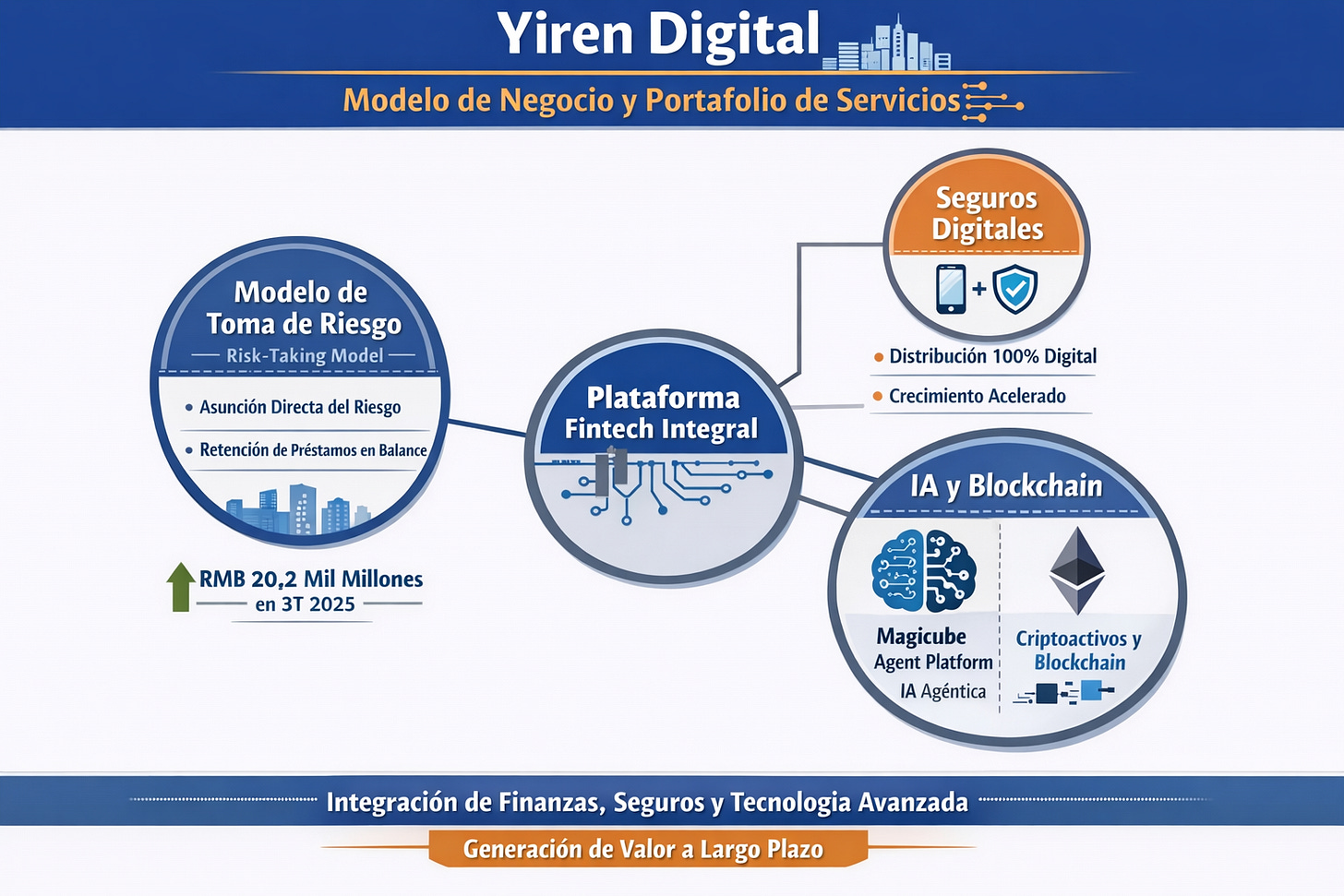

Yiren Digital is a leading Chinese fintech company founded in 2012 that has reshaped how customers access financial services. Through an innovative digital platform, it integrates multiple solutions—such as financing, wealth planning, and personal well-being—offering a comprehensive approach to personal financial management.

Today, the company is no longer defined solely by its origins in the P2P model or its initial holistic focus. Its identity has evolved into that of a leading fintech player specializing in digital consumer lending, insurance, and financial innovation, with operations spanning China and Southeast Asia. This transformation has been accompanied by a deep evolution of its business model and service portfolio.

Risk-taking model: Yiren Digital has successfully completed its transition to a risk-taking model, under which it directly assumes the credit risk of loans originated on its platform. This strategic shift has driven significant growth in loan origination volumes, reaching RMB 20.2 billion in the third quarter of 2025.

Digital insurance: The insurance division has migrated to a fully digital distribution model, achieving rapid growth through online insurance channels and strengthening its positioning in this segment.

Leadership in AI and blockchain: The company has launched the Magicube Agent Platform, advancing the development of agentic AI capabilities to optimize operational efficiency and decision-making. In parallel, it has made a strategic move into digital assets, incorporating cryptoassets—such as Ethereum—into its balance sheet.

Corporate Structure and Operations

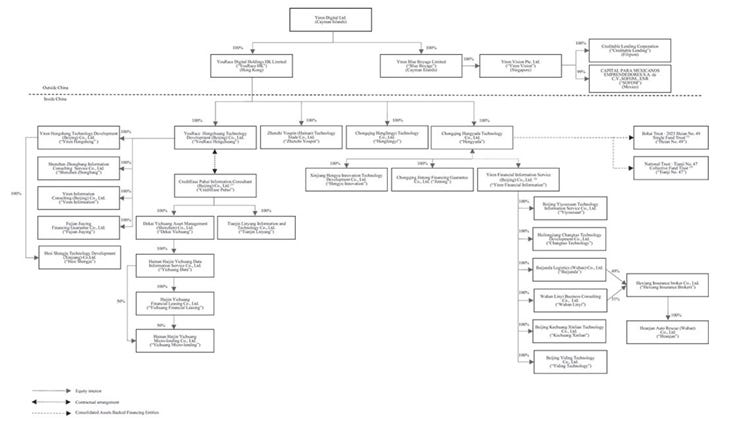

Yiren Digital Ltd. is a Cayman Islands–based holding company that does not conduct operations directly. Instead, it manages its business through subsidiaries and consolidated variable interest entities (VIEs) with which it maintains contractual arrangements. Because Chinese laws and regulations restrict foreign investment in certain internet and telecommunications-related services, these operations in China are carried out through VIE structures.

It is also important to note that Yiren Digital does not hold direct equity ownership in these entities. Rather, it relies on contractual agreements that allow it to receive the majority of the economic benefits and grant it an exclusive option to acquire equity interests in these entities when permitted under Chinese law. As a result of these arrangements, Yiren Digital is considered the primary beneficiary of the VIEs for accounting purposes, which enables it to consolidate their financial results in accordance with U.S. Generally Accepted Accounting Principles (U.S. GAAP).

In terms of revenue contribution, the VIEs accounted for 71.3%, 53.0%, and 33.2% of Yiren Digital’s total revenues in 2021, 2022, and 2023, respectively. Some of the consolidated VIEs include CreditEase Puhui, Yichuang Financial Leasing, Yichuang Micro-lending, and several others, each specializing in different areas of financial services and technology. It is important to emphasize that investors holding Yiren Digital’s ADSs do not own equity interests in these VIEs, but rather in the Cayman Islands–registered holding company.

Risks

VIE (Variable Interest Entity) Structure: The company relies on contractual arrangements with VIEs in China to operate in sectors that are restricted to foreign investment. This entails legal risks, as these agreements are not as robust as direct ownership and could be challenged by Chinese authorities.

Regulatory Environment in China: Rapid changes in cybersecurity, data privacy, and financial services regulations may negatively impact the company’s operations. In addition, uncertainty in the interpretation and enforcement of these laws adds further complexity.

Permits and Licenses: Although Yiren Digital has obtained the licenses required to operate its business, it may need to secure additional approvals in the future as regulatory frameworks evolve.

Government Oversight: The Chinese government exercises significant authority over the operations of companies such as Yiren Digital, which could limit its ability to offer securities to foreign investors or affect the value of its shares.

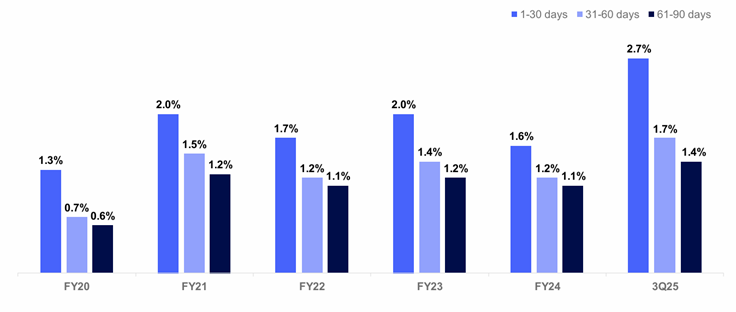

While Yiren Digital benefits from lower antitrust pressure compared to China’s major technology giants, its recent transition to a risk-taking model and its expansion into digital assets increase its sensitivity to credit cycles and market volatility. The strength of its cash position (RMB 4.3 billion) serves as its primary buffer against these risks; however, the upward trend in delinquency rates (from 1.7% to 2.7%) warrants close monitoring in the coming quarters

Products and Services

Yiren Digital is currently positioned as a leading financial technology (fintech) company specializing in digital consumer lending, insurance brokerage, and technological innovation, with a presence across China and Southeast Asia. The company has evolved into an ecosystem driven by Artificial Intelligence (AI) and enabled by blockchain technology.

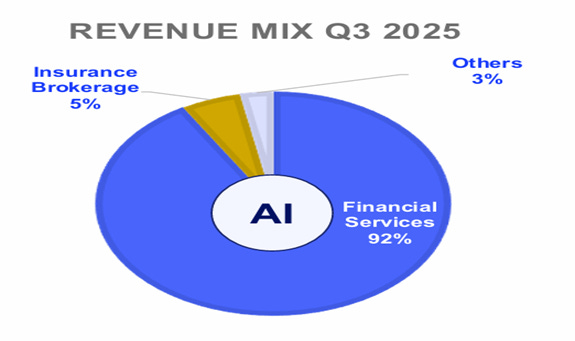

Financial Services (Core Operations) : This segment is the company’s primary growth engine, accounting for 92% of total net revenues as of the third quarter of 2025.

Consumer Focus: The company specializes in small, revolving loan products, supported by strong demand and a high level of repeat usage among existing customers.

Risk-Taking Model: YRD has completed its transition to a model in which it assumes the credit risk of loans facilitated through its platform. This approach allows the company to sustain loan origination volumes despite banking constraints, although it entails higher accounting provisions.

Strategic Credit Management: In response to industry volatility, the company applies a strategic adjustment to its credit policies, prioritizing asset quality over user volume.

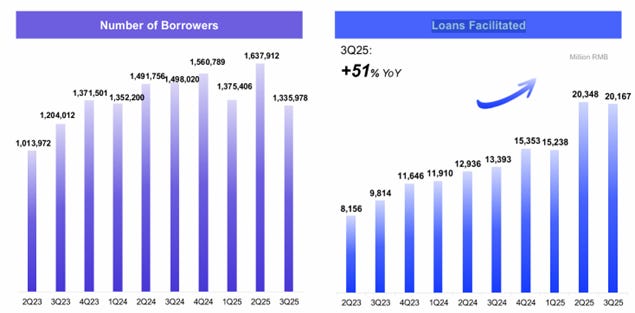

Volume Growth: Total loans facilitated reached RMB 20.2 billion in the third quarter of 2025, representing a 51% year-over-year increase.

Insurance Brokerage (Undergoing Digital Transformation)

The insurance division is undergoing a strategic restructuring aimed at mitigating the decline in traditional commission-based revenues.

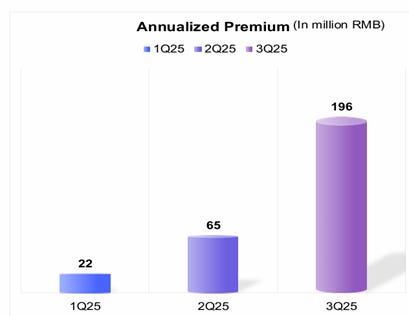

“Internet Insurance” Strategy: The company has pivoted toward online insurance distribution, achieving a 204% quarter-over-quarter increase in annualized premiums from digital insurance products.

Gross Written Premiums: During the third quarter of 2025, Yiren Digital managed RMB 1.148 billion in gross written premiums, driven by both the expansion of the new digital channel and strong renewal performance.

Technological Innovation and Digital Assets (The New Frontier)

YRD is building a new growth engine centered on emerging technologies.

Agentic AI (Magicube Agent Platform): The company has launched this platform to advance its agentic AI capabilities, with the goal of improving operational efficiency and alleviating margin pressure arising from the current credit cycle.

Expansion into Digital Assets: The company has initiated a strategic entry into the digital assets business. Its current balance sheet includes cryptoassets (primarily Ethereum), which generated a fair value adjustment gain of RMB 161.3 million during the analyzed quarter.

Business Model

Main Revenue Sources

A. Financial Services (Core Business 92% of Net Revenues)

2. Revolving Loans: A strong focus on fast-turnover consumer credit products with high recurrence rates.

3. Key Metrics: Total loan origination volume of RMB 20.2 billion, representing a 51% year-over-year increase.

4. Monetization:

B. Insurance Brokerage (In Digital Transition)

Pivot toward “Internet Insurance”: In response to declining traditional commissions, the company has shifted its focus toward digital insurance distribution.

Growth: Online insurance premiums increased by 204% on a quarter-over-quarter basis.

Monetization: Commission income derived from gross written premiums, which totaled RMB 1.148 billion in Q3 2025.

C. Digital Assets (The New Revenue Stream)

Expansion into Blockchain: YRD has begun generating meaningful income through the management of digital assets.

Ethereum (ETH): The company currently holds ETH on its balance sheet, which resulted in a fair value adjustment gain of RMB 161.3 million in the most recent quarter

D. Technology and Key Capabilities

Agentic AI (Magicube Agent Platform): YRD has evolved from basic analytical AI to Agentic AI, deploying autonomous agents to optimize collections, customer service, and risk assessment, significantly improving operational efficiency.

Advanced Data Analytics: The ability to process thousands of variables in real time, which is critical to managing the new risk-taking model.

Blockchain-Enabled Infrastructure: Supporting the management and operation of its digital assets division.

E. Acquisition and Distribution Channels

Quality Optimization: The company has shifted its focus from maximizing volume to prioritizing quality. Although the number of borrowers declined by 11% (to 1.3 million), loan volumes increased, indicating higher-value customers with larger average ticket sizes.

Recurrence: A strong emphasis on existing customers to reduce customer acquisition costs (CAC).

F. Growth Strategy

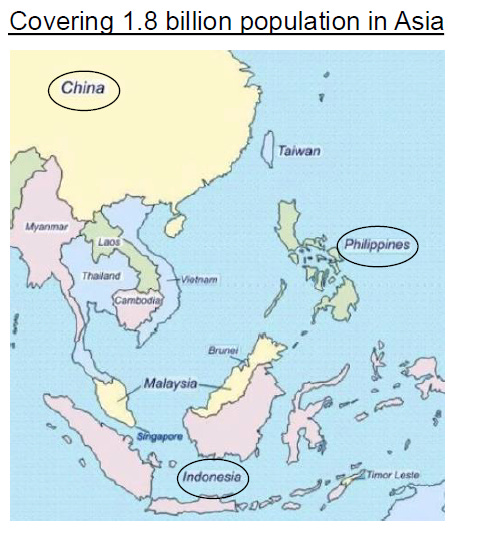

International Expansion: Active expansion into the Philippines and Indonesia, targeting markets with lower regulatory pressure compared to China’s domestic market.

Balance Sheet Strength: Leveraging its RMB 4.3 billion cash position to support the guarantee model and invest in new technologies (AI and crypto).

Fintech–Crypto Synergy: Integration of digital assets into the company’s traditional financial ecosystem.

G. Key Strengths and Risks (Updated)

Strengths

Robust Liquidity: RMB 4.3 billion in cash, providing a strong buffer to absorb risks and support future growth.

Strategic Agility: A proven ability to exit unprofitable businesses while opening new growth frontiers in crypto and AI.

Southeast Asia Exposure: Early positioning in high-growth emerging markets across Southeast Asia.

Current Risks

Asset Quality: The 1–30 day delinquency rate increased to 2.7% from 1.7%, reflecting ongoing industry-wide volatility.

Provisioning Pressure: The risk-taking model requires substantial capital reserves (RMB 459.8 million in provisions), placing pressure on net profitability.

Executive Summary (Personal View)

Looking ahead to 2025–2026, I see Yiren Digital (YRD) as one of the most resilient and well-positioned players in China’s fintech space. The company has successfully moved away from a pure volume-driven approach toward a model centered on balance sheet strength, risk discipline, and long-term solvency. By exiting non-core businesses and embracing a risk-taking model—where it directly assumes credit risk instead of relying on banks—YRD has strengthened its role within the financial system, maintaining solid loan origination levels (RMB 20.2 billion in Q3 2025) while improving margins.

What stands out to me is how the company’s growing provisioning and its sizable cash position (RMB 4.3 billion) act as a real defensive moat. In a regulatory environment that is likely to push weaker competitors out of the market, this balance sheet strength gives YRD room to not only survive, but potentially gain market share, even if delinquency rates rise in the short term. At the same time, the company is clearly not standing still: it is using AI to improve credit scoring and collections, exploring blockchain and digital assets to diversify revenue, and expanding into Southeast Asia, where regulatory pressure is lower and growth opportunities are more attractive.

With more than 100 million users and strong customer recurrence, my investment thesis is straightforward. I believe Yiren Digital has a realistic chance to emerge as one of the last major fintech players standing in this segment. The key risk remains a deterioration in credit quality in China, but so far, management appears aware of this and is responding with capital discipline and a clear focus on higher-quality borrowers rather than chasing growth at any cost.

No comments:

Post a Comment